Auto Enrolment & Workplace Pension Provision - A Guide for HR & Payroll Professionals

Introduction

Automatic enrolment was introduced in the UK in 2012 and took 6 years to fully implement. All employers in the UK are required to assess their workforce and take appropriate action based on the results.

This virtual classroom seminar guides you through the requirements of automatic enrolment and re-enrolment, as well as an insight into the different types of pension schemes and how the tax relief is provided.

What You Will Learn

This live and interactive session will cover the following:

- Automatic enrolment process

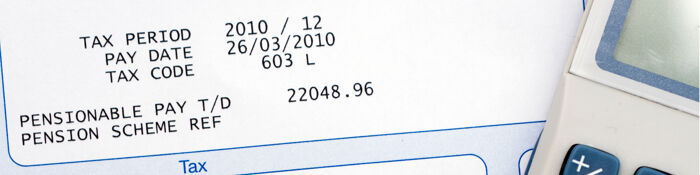

- Tax relief and pensions

- Qualifying earnings, pensionable pay and the earnings’ trigger

- Using postponement

- How to auto-enrol and re-enrol

- Optional remuneration arrangements (salary sacrifice) and pensions

- Workplace pensions and statutory leave

- Handling opt-ins, opt-outs and cessations

Recording of live sessions: Soon after the Learn Live session has taken place you will be able to go back and access the recording - should you wish to revisit the material discussed.