Global Mobility & Tax Equalisation - A Guide for HR & Payroll Personnel

Introduction

This webinar will provide a high-level overview of the role of tax equalisation in setting appropriate reward packages for expatriate employees.

This webinar is aimed at HR and payroll personnel.

What You Will Learn

This webinar will cover the following:

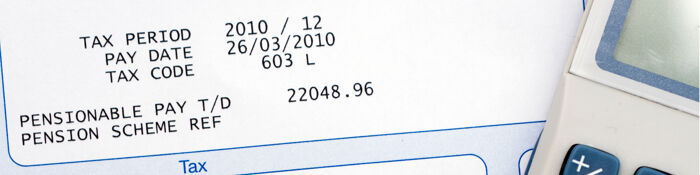

- Setting remuneration packages and the impact of tax

- First principles

- The three common models used

- Issues to address when running a scheme

- Example calculations

This webinar was recorded on 19th January 2023

You can gain access to this webinar and 1,700+ others via the MBL Webinar Subscription. Please email webinarsubscription@mblseminars.com for more details.