Payroll & Social Security in the ROI - Latest Budget Update

Introduction

The first full budget from Ireland’s three way coalition government is eagerly awaited. This Learn Live session will provide a full commentary on the budget proposals from the viewpoint of employer payroll responsibilities. It will also consider relevant changes to employment law including statutory leave and the expansion of the sectorial employment order system.

What You Will Learn

This live and interactive course will cover the following:

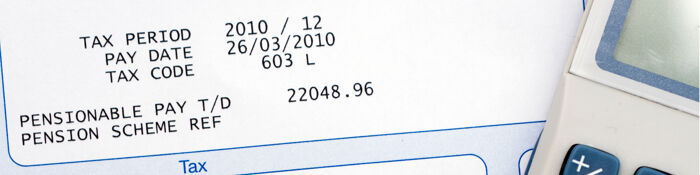

- Tax credits and Standard Rate Cut Off point

- Tax rates and calculations

- Changes to ROS reporting requirements

- Universal Social Charges - rates, thresholds, and rules

- Pension schemes - maximum contributions, thresholds, and enrolment obligations

- PRSI rates and thresholds

- DSP benefit rates

- Changes to family leave entitlement

- Statutory Sick Pay - rules and entitlements

- Changes to employment law relevant to payroll

Recording of live sessions: Soon after the Learn Live session has taken place you will be able to go back and access the recording - should you wish to revisit the material discussed.